2022 tax brackets

37 for individual single taxpayers with incomes greater than 578125 693750 for. The 2022 tax brackets affect the taxes that will be filed in 2023.

Tax Brackets For 2021 And 2022 Ameriprise Financial

To access your tax forms please log in to My accounts General information.

. Heres a breakdown of last years income. The top marginal income tax rate. There are seven federal tax brackets for the 2021 tax year.

There are seven federal income tax rates in 2023. 15 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class. 10 12 22 24 32 35 and 37.

The income brackets though are adjusted slightly for inflation. These are the 2021 brackets. You can see all the.

If you can find 10000 in new deductions you pocket 2400. Each of the tax brackets income ranges jumped about 7 from last years numbers. Here are the new brackets for 2022 depending on your income and filing.

1 day agoBelow are the new brackets for both individuals and married coupled filing a joint return. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. 1 day agoThe IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples.

That puts the two of you in the 24 percent federal income tax bracket. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. Here are the 2022 Federal tax brackets.

17 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. 17 hours ago2022 tax brackets for individuals Individual rates. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year.

Your bracket depends on your taxable income and filing status. 20 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. There are seven federal income tax rates in 2022.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Individual Income Tax Return form is shown July 24 2018 in New York. These are the rates for.

A portion of the 1040 US. You and your spouse have taxable income of 210000. Below you will find the 2022 tax rates and income brackets.

The 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022. The top marginal rate or the highest tax rate based on.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 15 hours agoThe 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022.

Taxpayers will get fatter standard deductions for 2023 and all seven federal. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year. The agency says that the Earned Income.

2022 tax brackets Thanks for visiting the tax center.

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Tax Brackets For 2021 2022 Federal Income Tax Rates

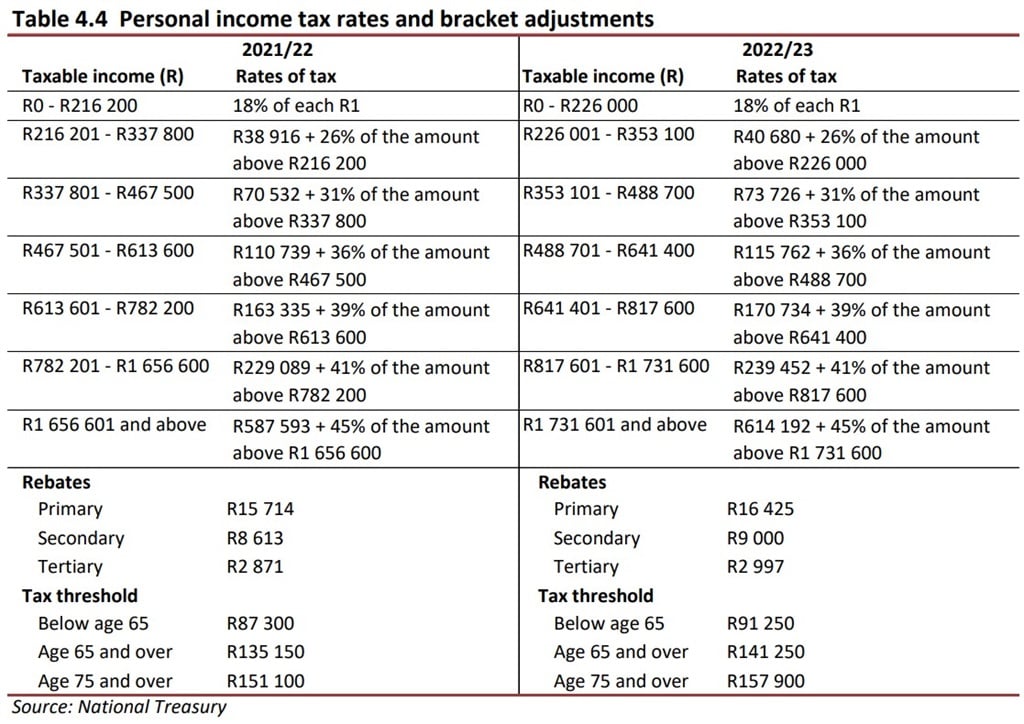

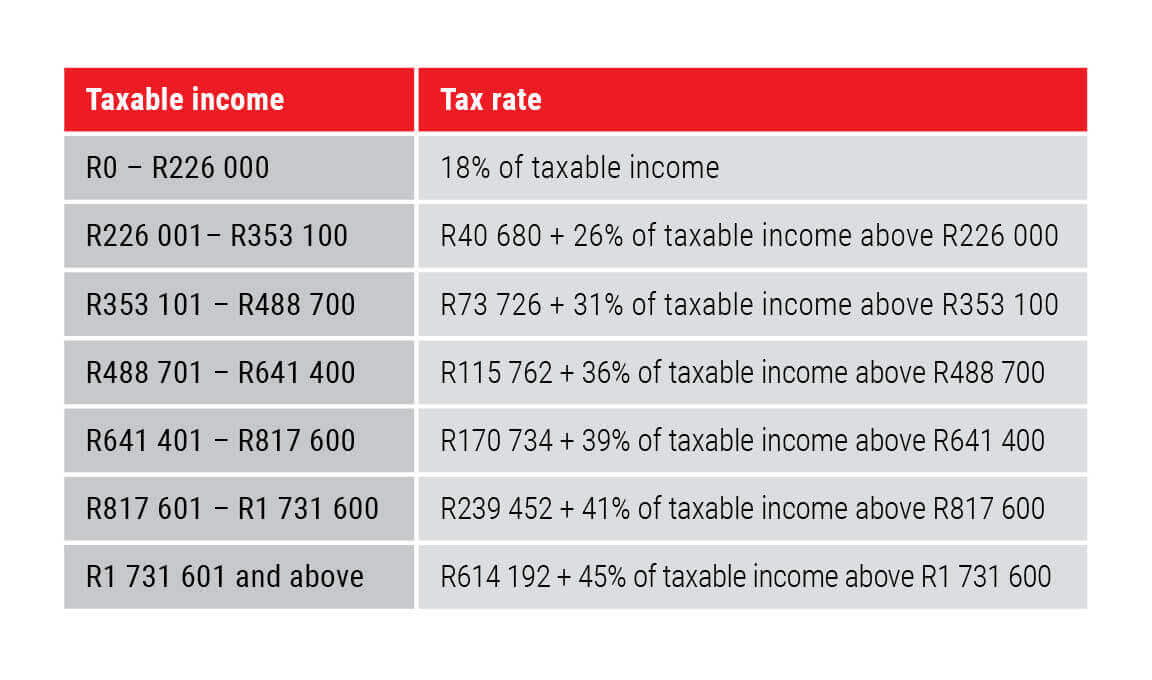

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

2022 Income Tax Brackets And The New Ideal Income

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

Allan Gray 2022 Budget Speech Update

Germany Corporate Tax Rate 2022 Take Profit Org

New 2022 Tax Brackets Ckh Group

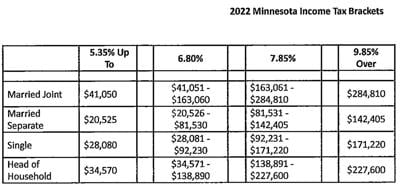

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com